401k 2025 Max Contribution Amount - 2025 Max 401k Contribution Limits Athena Aloisia, However, there is a limit that applies to total contributions, meaning the sum of the employee portion and employer match. 2025 Max 401k Contribution Limits Debbie Lyndel, Total contributions to a solo 401 (k) cannot exceed $69,000 or $76,500 for those at least aged 50.

2025 Max 401k Contribution Limits Athena Aloisia, However, there is a limit that applies to total contributions, meaning the sum of the employee portion and employer match.

2025 401k Maximum Compensation Rea Leland, Employees 50 or older can contribute up to $30,500 with.

Irs 2025 Max 401k Contribution Limits Ruthy Peggie, 2025 retirement account contribution amounts.

Maximum 401k Contribution 2025 Over Inflation Lia Tandie, The 401 (k) contribution limit is the maximum amount an individual can contribute to their 401 (k) retirement account in a calendar year without facing tax penalties.

2025 Max 401k Compensation Brana Brigitte, Employees 50 or older can contribute up to $30,500 with.

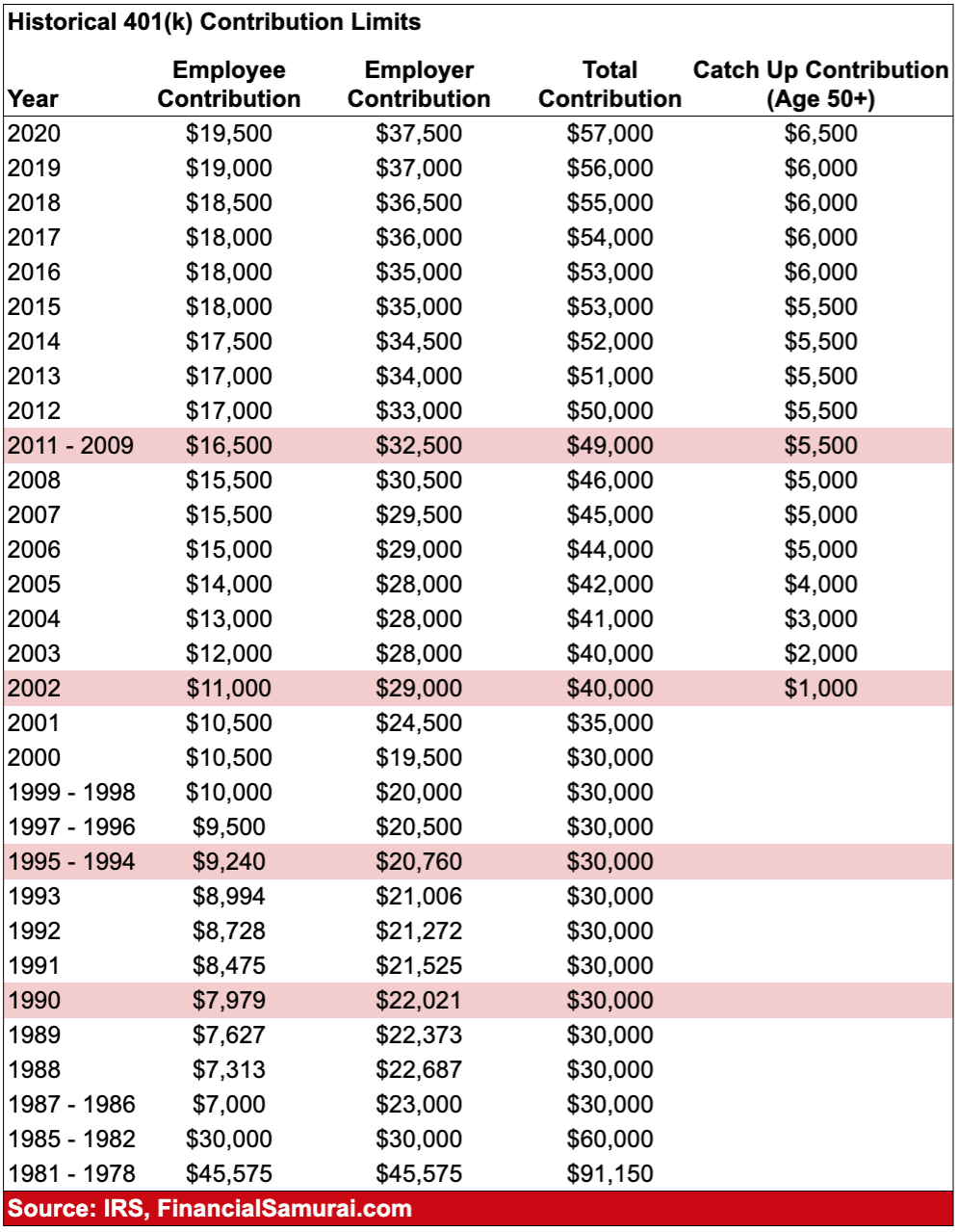

Max 401k Contribution With Catch Up 2025 Alia Louise, The 401(k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.

Those 50 and older can contribute an additional $7,500. Workers who cash out traditional 401(k) accounts must pay income tax on that amount, and if they are younger than 55, typically face a 10% early withdrawal penalty.

401k 2025 Max Contribution Amount. For gen z, those born between 1997 and 2025, the roth 401(k) contribution rate was 16.8%. For 2025, the 401(k) limit for employee salary deferrals is $23,000, which is above the 2023 401(k) limit of $22,500.

401k 2025 Contribution Limit Chart, The total 401(k) contribution limit in 2025 is $69,000, including employee and employer contributions.

What Is The Maximum Amount Of 401k Contribution For 2025 Emili Janessa, 2025 retirement account contribution amounts.